Buying a home is often described as one of life’s most significant milestones. It’s an exciting journey, but it can also be overwhelming, especially for first-time buyers. With so many things to consider, it’s easy to feel lost in the process. That’s where a well-crafted home buying checklist comes in handy. This article will guide you through the essential steps of purchasing a home, helping you navigate the journey with confidence and ease.

Assess Your Financial Readiness

Before you start browsing listings and attending open houses, it’s crucial to closely examine your financial situation.

Check Your Credit Score

Your credit score plays a vital role in determining your mortgage eligibility and interest rates.

- Request a free credit report from the three major credit bureau

- Review your report for any errors and dispute them if necessary

- Aim for a credit score of at least 620, though 700 or higher is idea

Determine Your Budget

Understanding how much home you can afford is crucial to avoid financial strain down the road.

- Calculate your debt-to-income ratio (DTI)

- Consider the 28/36 rule: Housing expenses should not exceed 28% of your gross monthly income, and total debt

payments should not exceed 36% - Factor in additional costs like property taxes, insurance, and maintenance

Did you know? Many financial experts recommend having 3-6 months of living expenses saved as an emergency fund

before buying a home.

Save for a Down Payment and Closing Costs

Saving for a down payment is often one of the biggest hurdles for homebuyers. Here’s what you need to know:

Down Payment

Don’t forget about closing costs, which typically range from 2% to 5% of the home’s purchase price.

- Aim for a 20% down payment to avoid private mortgage insurance (PMI)

- Explore down payment assistance programs in your area

- Consider FHA loans, which allow for down payments as low as 3.5%

Closing Costs

- Appraisal fees

- Title insurance

- Attorney fees

- Origination fee

Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage gives you a clear idea of how much you can borrow and shows sellers you’re a serious buyer.

- Gather necessary documents (pay stubs, tax returns, bank statements)

- Shop around for the best mortgage rates and terms

- Consider different types of mortgages (fixed-rate, adjustable-rate, FHA, VA)

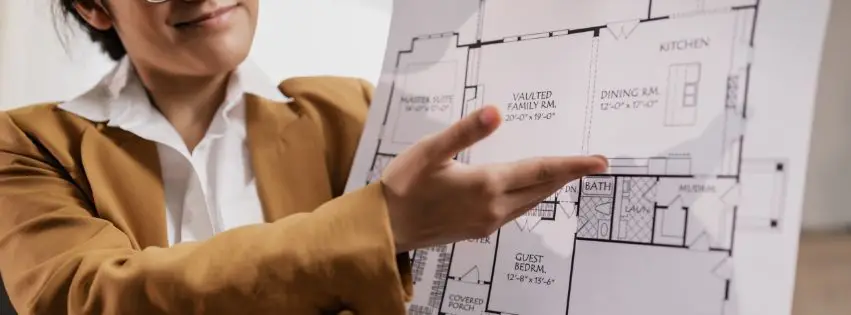

Define Your Home Preferences

Before you start house hunting, make a list of your must-haves and nice-to-haves.

Location Considerations

- Proximity to work, schools, and amenities

- Neighborhood safety and future development plans

- Commute times and public transportation options

Home Features

- Number of bedrooms and bathrooms

- Size of the yard

- Style of home (single-family, townhouse, condo)

- Age of the home and potential renovation needs

Find a Real Estate Agent

A good real estate agent can be invaluable in your home-buying journey.

- Ask for recommendations from friends and family

- Interview multiple agents to find the right fit

- Look for someone with experience in your target neighborhoods

Start House Hunting

Now comes the exciting part – looking at potential homes!

- Attend open houses and schedule private viewings

- Take notes and photos to help remember each property

- Don’t be afraid to visit a property multiple times

Make an Offer and Negotiate

When you find the right home, it’s time to make an offer.

- Work with your agent to determine a fair offer price

- Include contingencies (like home inspection and financing)

- Be prepared for counteroffers and negotiations

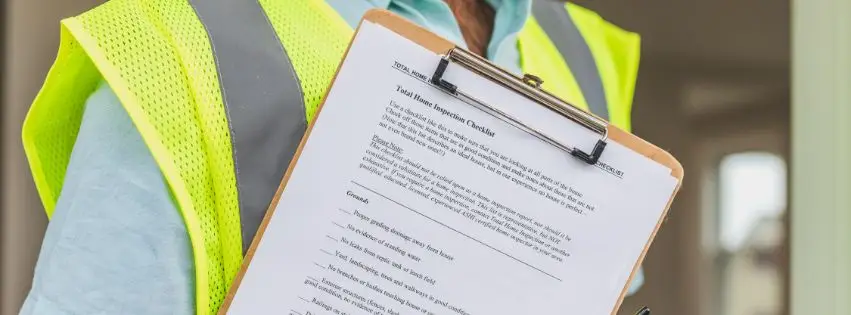

Conduct Due Diligence

Once your offer is accepted, it’s time to dive deeper into the property’s condition and history.

Home Inspection

- Hire a professional home inspector

- Attend the inspection and ask questions

- Review the inspection report thoroughly

Title Searches

- Ensure there are no liens or ownership disputes on the property

- Consider purchasing title insurance for added protection

Secure Your Financing

Finalize your mortgage details with your lender.

- Lock in your interest rate

- Provide any additional documentation requested by the lender

- Avoid making major purchases or changes to your credit during this time

Prepare for Closing

As you approach the finish line, there are a few more tasks to complete.

- Schedule a final walk-through of the property

- Review closing documents in advance

- Arrange for homeowner’s insurance

- Get certified checks for closing costs and down payment

Conclusion

Buying a home is a complex process, but with this comprehensive checklist, you’re well-equipped to tackle each step with confidence.

Remember, every home-buying journey is unique, so don’t hesitate to seek advice from professionals along the way. Your real estate agent will guide you though the process. With careful planning and preparation, you’ll soon be turning the key to your new home.

Pro Tip: Create a dedicated email folder or physical file to keep all your home-buying documents organized and easily accessible throughout the process.

Happy house hunting!